will capital gains tax increase in 2021

The effective date for this increase would be September 13 2021. Former Vice President Joe Bidens tax plan would take away the preferential 20 maximum capital gains rate for those with income levels about 1 million.

What You Need To Know About Capital Gains Tax

Capital Gains Tax Rates for 2021.

. Rates range from 10 to 37. The Biden administration has proposed an increase in the current favorable capital gain rates for people earning more than 1 million. Capital gains tax rates on most assets held for a year or less correspond to.

The bank said razor-thin majorities in the House and Senate would make a big increase difficult. Short-term capital gains are taxed as ordinary income meaning the rates are the same as for the income you earn from your job or any other earned income source. The rate could be as high as 396 matching the top ordinary income tax rate before the Tax Cuts and Jobs Act TCJA.

And CapGainsValet predicts 2021 will see more than double the historical average of funds making distributions of more than 10. A Guide to Understand Your Options With RSUs Deferred Comp Plans More. The federal long-term capital gains tax is lower than both its short-term counterpart and income tax rates.

Because of marginal tax brackets your effective tax rate meaning the average tax rate you pay on all your. Democrats are discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced. In some other places these gains may be taxed at a flat rate.

NDPs proto-platform calls for levying. The proposal would increase the maximum stated capital gain rate from 20 to 25. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers a rise of 25 for a higher and additional rate taxpayers.

Discover Helpful Information and Resources on Taxes From AARP. These frequently asked questions are based on the latest information on the outlook. Instead investors would have to pay their.

Ad Wealth Enhancement Group Provides Comprehensive Financial Guidance Nationwide. Zara cut-out dress black. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

The bottom 99 on. This is also true for some states as there may be a system of tax brackets where the rate is higher as the money earned increases. Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large gains treated as.

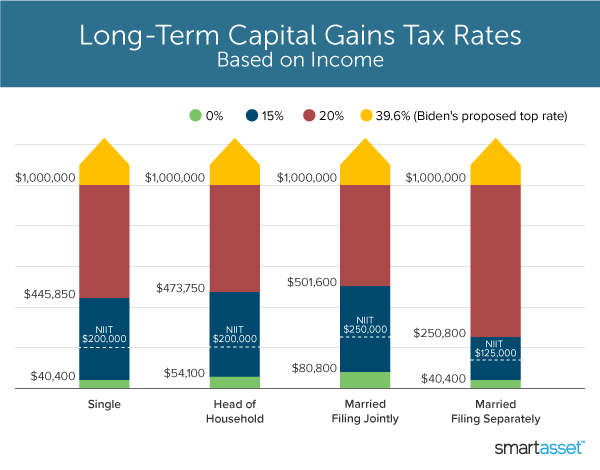

As proposed the rate hike is already in effect for sales after April 28 2021. It also includes income thresholds for Bidens top rate proposal and the 38 NIIT. Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021.

Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. Ad The Leading Online Publisher of National and State-specific Legal Documents. Your 2021 Tax Bracket to See Whats Been Adjusted.

Single taxpayers with between roughly 40000 and 446000 of income pay 15 on their long-term capital gains or dividends in 2021. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Ad Compare Your 2022 Tax Bracket vs.

Capital gains tax is likely to rise to near 28 rather than 396 as Joe Biden plans Goldman said. Thats 50 more funds predicted to make large taxable distributions of more than 10 this year versus the next highest year 2018. Capital gains tax increase 2022 aetna dental ppo fee schedule 2022 pdf capital gains tax increase 2022 barstool sports sling promo capital gains tax increase 2022.

35 Trillion Spending Package Update Under the Biden-Democrat social infrastructure plan long term Capital gains tax rates could increase to 25 from 20 for people earning over 400000 or those in the highest tax bracket. 3718 60th street west rosamond ca 93560. The top 01 a group of just 120000 people earning an average of more than 11 million a year earned more than half of all capital gains income in the United States in 2019.

The 238 rate may go to 434 an 82 increase. House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci. If you have a long-term capital gain meaning you held the asset for more than a year youll owe either 0 percent 15 percent or 20 percent in.

Get someone to do something examples. Add state taxes and you may be well over 50. California Capital Gains Taxes.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. 2021-2022 Short-Term Capital Gains Tax Rates. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

Democratic tax writers are launching mark-ups for the reconciliation bill. Short-term gains are taxed as ordinary income. Under Bidens proposal all taxpayers making more than 1 million in long-term capital gains would have to pay the 396 rate in addition to the 38 NIIT.

Mote marine promo code 2021. Capital Gains Tax Rate Update for 2021. Those with less income dont pay any taxes.

Get Access to the Largest Online Library of Legal Forms for Any State. Happy labour day quotes 2022. Capital gains tax increase 2022.

The 15 Best Growth Stocks for the. This would take effect in 2022. The table below breaks down long-term capital gains tax rates and income brackets for tax year 2021.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Pay 0 Capital Gains Taxes With A Six Figure Income

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

What You Need To Know About Capital Gains Tax

What S In Biden S Capital Gains Tax Plan Smartasset

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2022 And 2021 Capital Gains Tax Rates Smartasset

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

What You Need To Know About Capital Gains Tax

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

2022 And 2021 Capital Gains Tax Rates Smartasset